Aggregates Reserves in Decline

First published in the October 2022 issue of Quarry Management

BDS publishes ‘Estimated Reserves of Pits & Quarries in Great Britain 2022’

The latest industry report just published by BDS Market Intelligence, ‘Estimated Reserves of Pits & Quarries in Great Britain 2022’, clearly illustrates that the landbank of consented reserves held by aggregates companies in Great Britain has seen a significant decline in recent years. This confirms the belief held by the industry bodies, aggregates producers, and other observers that replenishment of extracted material through the planning process is falling behind what is critical to the delivery of all construction projects and the ambitions of the Government to meet infrastructure, housing, and other service needs.

The headline figures are that at the end of 2021, the industry held an estimated 5.5 billion tonnes of consented aggregates reserves with an overall life remaining of 31 years. This equates to 12 years for sand and gravel and 39 years for crushed rock. Whilst these figures are not insignificant and, on the face of it, may suggest a healthy pipeline of construction materials, BDS have identified that the respective figures have fallen by close to 20% since 2016 when this was last reported on by the consultancy. Sand and gravel reserves have fallen from 14.5 years, whilst crushed rock previously stood at 49 years. The falls have continued a trend reported by BDS which reveals that in the last nine years, since an earlier BDS report in 2013, the decline has been closer to 30% for both sand and gravel and crushed rock.

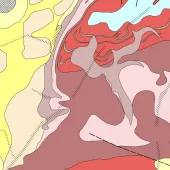

In their latest research, BDS have carried out a detailed analysis of every active and inactive sand and gravel pit and crushed rock quarry across Great Britain to identify the consented reserves held at each site. Sources include planning documents, RAWP reports and monitoring statements, discussions with planning officers and aggregates producing companies, and in-house BDS research. Using other data held by BDS covering the estimated outputs of active sites in recent years, which is published elsewhere, allows the remaining years life for each site, and overall, to be calculated.

In the new report an estimate is provided for every one of the 925 active and inactive sand and gravel pits and crushed rock quarries with consented reserves in Great Britain, along with an estimate of the years of life remaining for each. The data are summarized at county, regional, and national level, and also identify company market shares at each level. This allows the data to be used by companies to compare against their competitors both locally and nationally, identify areas of weakness, and identify opportunities for expansion and acquisition. New entrants to the industry, industry observers, and other interested parties will find the report of significant value, providing a level of detail not available anywhere else.

The latest figures do not mean that the industry is suddenly going to find itself without aggregates. However, there are issues that need to be addressed by government and aggregates-producing companies to ensure:

- provision of an adequate supply of aggregates, including primary (land-won and marine), recycled, and secondary sources

- confidence that primary reserves (of sand and gravel and crushed rock) are replenished.

A quarter of pits and quarries with permitted reserves are currently closed and these hold more than a billion tonnes of consented reserves. Some of these sites have never opened since planning consent was granted; others closed during the recession or during COVID and have not reopened. It will need significant investment at many of these sites to bring them on stream. It may not be economic to develop all of these sites – due to poor mineral quality or the high cost to access the reserves. In these cases, the stated landbanks will turn out to be lower. As an illustration, if none of these sites reopened, the average life remaining for aggregates reserves in Great Britain would fall by a further seven years, to 24 years.

The high-level statistics do not show the complete picture. On a geographical basis, Scotland holds around 27% of the total reserves for Great Britain but accounted for less than 8% of new orders for construction reported by the Office for National Statistics (ONS) in 2021. The South East, in contrast, holds less than 2% of reserves but its share of construction output was 33% of the total. Just four regions – Scotland, East Midlands, South West, and Wales – account for close to 75% of total reserves. These points illustrate the significant issue of how, based on existing consented reserves, aggregates in the future will get to the markets that most need them.

The full report has also identified that more than 200 pits and quarries (30% of the currently active sites) are likely to exhaust their remaining reserves within five years, ie by the end of 2026. Of these, 144 are sand and gravel pits and 63 are crushed rock quarries. This is a significant increase on the last report in 2016 when a total of 150 active sites were expected to close within five years.

The report also reveals that 22 individual counties have sand and gravel landbanks with 10 years or less life remaining. Of these, seven have an estimated life remaining of five years. On a regional basis, there are four regions as a whole that are likely to have no sand and gravel reserves in 10 years’ time, based on existing reserves and estimates of recent outputs.

The five major national aggregates-producing companies – Aggregate Industries, Breedon, CEMEX, Hanson, and Tarmac – continue to hold the majority of reserves. Between them they account for around 78% of the total for Great Britain. For sand and gravel this figure falls to just under 60% and increases to 80% for crushed rock. Between them they have close to 400 of the 925 sites identified in the report. The remaining 530 sites are operated by another 290 companies operating at a regional, county, or local level.

In recent years there has been recognition that private and public sector parties (ie national government, local and regional planning authorities, industry bodies, and aggregates-producing companies) need to engage and co-ordinate activity to ensure aggregates are available and accessible when needed by the industry. This continues to be particularly important for the future, especially considering the current market position and the need for continued growth and development of the country.

A review of planning consents, the monitoring of which has been carried out by BDS for almost 30 years, in the period January 2017–December 2021 has identified 511 million tonnes of new reserves. However, this is set against the extraction of an estimated 800 million tonnes of primary land-won aggregates over the same period.

In 2021 alone, around 47 million tonnes of sand and gravel were extracted, yet only 26 million tonnes of new reserves were consented. This equates to a replenishment rate of just 55%. Crushed rock fared better last year, achieving a replenishment rate of 83%. The picture presented in this report of a declining aggregates reserves landbank in Great Britain is supported by other annual BDS research into replenishment rates which shows that in the period 2014–2021 only four out of every five tonnes of sand and gravel extracted were replaced by new consents, whilst for crushed rock, for every two tonnes extracted just over one tonne of new reserves was consented.

As things stand, around 144 million tonnes of reserves were the subject of planning applications submitted over the same period that are yet to be determined at the end of 2021. This is split approximately 30:70 between sand and gravel and crushed rock schemes. If all are consented, this figure will only extend the overall life remaining for reserves in Great Britain by just under a year, based on average levels of extraction over the last three years.

At a macro level, the report reinforces the industry’s need for greater support through the planning process and other legislation to enable it to deliver the materials required to support the growth platform set out by the Government. At a micro level, it sheds light on the consented reserves situation in Great Britain from each individual site upwards, allowing a clear picture to be drawn across all geographical areas by type of aggregate and by operating company. For further details of how to obtain a copy of the report, contact BDS by email at: contact@bdsmarketing.co.uk; or phone: (01761) 433035.

- Subscribe to Quarry Management, the monthly journal for the mineral products industry, to read articles before they appear on Agg-Net.com