Weak start to 2025 for GB heavy-side building materials sales

Mineral Products Association says demand has weakened amid growing economic headwinds

CONSTRUCTION demand for heavy-side materials in Great Britain has weakened further at the start of this year, according to the latest sales volumes survey by the Mineral Products Association (MPA).

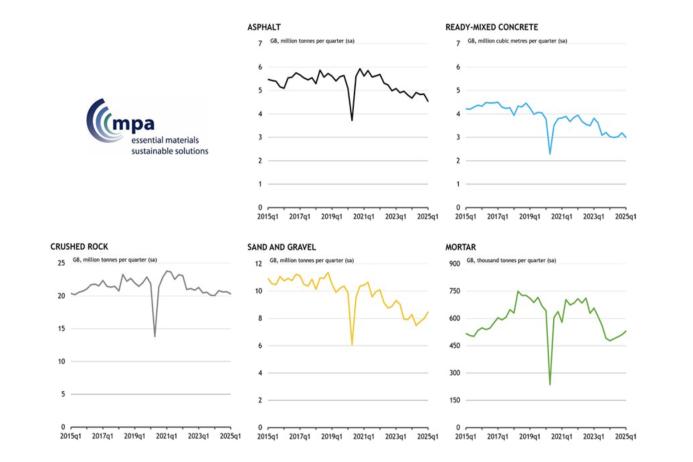

Sales of ready-mixed concrete and asphalt both fell by 6.3% in the first quarter of 2025 compared with the previous quarter, while primary aggregates (crushed rock and sand and gravel) recorded a modest increase of 0.5%. Mortar sales provided a rare bright spot, rising for a fourth consecutive quarter (by 3.8%) and signalling tentative improvement in house-building activity.

The latest results reflect the continuing challenges facing the construction sector and its supply chain, including patchy economic growth, cost pressures, persistent planning delays, and project cancellations, all of which continue to undermine confidence to invest in new projects. Ready-mixed concrete demand – a material essential to all types of construction – has fallen to around 3 million cubic metres per quarter, its lowest level in 60 years.

Infrastructure markets present a mixed picture. Major projects such as HS2, Hinkley Point C, and Sizewell C, alongside several offshore wind projects under way, continue to support demand for construction mineral products, particularly aggregates and ready-mixed concrete. However, this strength is being offset by significant weakness in the roads sector.

Asphalt sales in the first quarter of 2025 were the lowest since 2013 outside of the pandemic period, impacted by the cancellation or delay of key strategic road schemes and continuing financial constraints on local authority maintenance budgets, despite government promises of a ‘record level of spending on fixing the road network’. Overall, broader infrastructure activity remains patchy, with delays and cost pressures continuing to challenge project delivery across both public and private sectors.

House-building activity, while still well below historical norms, is showing some signs of recovery. Mortar sales have risen for four consecutive quarters, suggesting a slow but steady improvement in house-building activity. However, the wider housing market recovery remains highly sensitive to household confidence and borrowing conditions, with higher mortgage rates and increased economic uncertainty since last autumn continuing to weigh on affordability and buyer sentiment.

Against this already challenging backdrop, new risks are emerging from the global economy. The introduction of new US trade tariffs has resulted in heightened uncertainty, which is expected to negatively impact UK growth prospects, construction activity, and prospects for the supply chain.

While the largely domestic mineral products sector is resilient to direct trade exposure, there are real risks that cement imports – already representing nearly a third of the UK market – could rise further as materials originally destined for the US (eg from Turkey) seek new markets. High energy, carbon, and labour costs in the UK compared with other international producers mean that domestic cement production cannot compete, accelerating the risk of deindustrialization in a sector that is essential to local jobs, supply chain resilience, and UK growth.

Global trade disruptions, reduced investor confidence, and renewed inflationary pressures are compounding existing headwinds for construction and mineral products markets. The pipeline of construction projects currently stalled due to low business confidence is likely to remain on hold for longer, delaying progress in the housing market, in large commercial and industrial construction, and in infrastructure where private investment is critical. At the same time, the potential for an even more cautious approach to interest rate cuts by the Bank of England risks undermining the fragile housing recovery, which has underpinned recent gains in mortar sales.

Commenting on the latest figures, Aurelie Delannoy, director of economic affairs at the MPA, said: ‘The latest data show that mineral products markets continue to struggle under the weight of heightened economic uncertainty and delayed investment decisions. While there are early signs of improvement in house building, the broader construction pipeline remains fragile. New global risks, particularly the potential impact of US trade tariffs, add further pressures at a time when the UK urgently needs a resilient and competitive domestic supply chain to support the Government’s green growth ambitions.’

The MPA’s latest market forecast, published in February, points to modest overall growth across mineral products markets in 2025, supported by major infrastructure projects and a hoped-for pick-up in house building in the second half of the year. However, the outlook is increasingly contingent on both supportive domestic policy action, and a more stable economic and policy environment.

Chris Leese, executive chair of the MPA, added: ‘Construction cannot happen without a secure supply of mineral products, yet domestic production faces mounting pressures from both home and abroad. Without a clear commitment to supporting UK industry through competitive energy costs, better planning, and a public procurement policy that prioritizes domestically produced mineral products like cement and concrete, the risk is that essential mineral extraction and products manufacturing capacity will be lost, just when the country needs it most. Government must act now to strengthen the foundations of growth and support an industry that supplies the essential materials underpinning the UK’s ambition to build and grow the economy.’

The MPA continues to urge the UK Government to act swiftly to strengthen the resilience of domestic mineral products production, including supporting energy cost competitiveness, industrial decarbonization, planning reform, and public procurement policies that support UK industries. Such action, it says, is essential to underpin the mineral products sector’s critical role in enabling economic growth, housing delivery, and national infrastructure ambitions.