UK construction growth eases in March

Fastest decline in housing activity since May 2020; Civil engineering the best-performing category

MARCH PMI data highlighted another rise in UK construction output, helped by a moderate increase in new orders. The civil engineering category saw the fastest rise in business activity, while house building was the weakest-performing area. Lower volumes of residential building work have now been recorded for four months in a row.

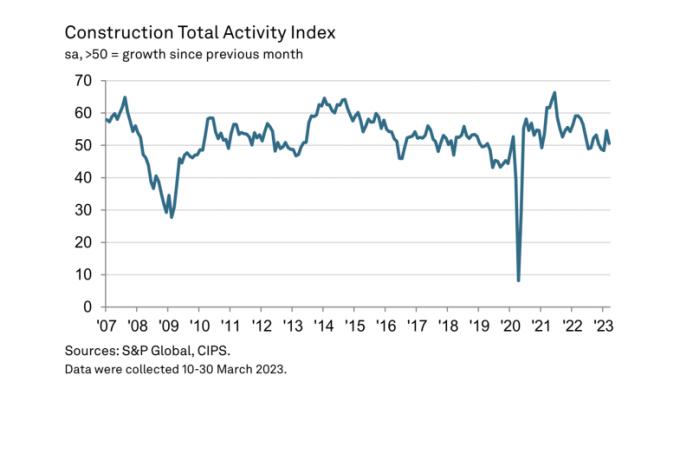

At 50.7 in March, the headline seasonally adjusted S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – was down from 54.6 in February but above the 50.0 no-change threshold for the second month running. The latest reading signalled a marginal overall increase in total construction output.

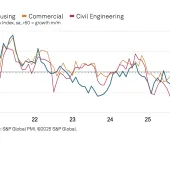

Civil engineering activity (index at 52.0) was the fastest- growing area of construction output in March. Survey respondents again cited a boost from work on HS2 infrastructure projects and robust demand for other transport-related construction activity.

The latest survey also signalled an increase in commercial building work (index at 51.1), although the rate of expansion eased from February's nine-month high. Meanwhile, housing activity (index at 44.2) decreased at a sharp and accelerated pace in March. The rate of decline was the fastest since May 2020, with survey respondents often citing fewer tender opportunities due to rising borrowing costs and a subsequent slowdown in new house-building projects.

March data also signalled the fastest improvement in suppliers’ delivery times for more than 13 years. Survey respondents widely noted that an improved balance between demand and supply had helped to boost the availability of construction products and materials.

Around 46% of the survey panel predict an increase in business activity during the year ahead, while only 11% foresee a reduction. The resulting index reading signalled the strongest degree of positive sentiment since February 2022. Optimism has rebounded strongly from the two-and-a- half year low seen in December, largely reflecting signs of a turnaround in client spending and a more favourable outlook for the wider UK economy.

Tim Moore, economics director at S&P Global Market Intelligence, who compile the survey, said: ‘UK construction companies experienced a sustained rebound in output levels during March as work on civil engineering and commercial projects picked up for the second month running.

‘A sharp and accelerated decline in house building was the main area of concern in March. Cutbacks to new residential projects in the wake of subdued demand and rising interest rates contributed to the sharpest fall in housing activity across the construction sector for almost three years.

‘Despite worries about the near-term outlook for housing activity, expectations for total construction output during the year ahead were relatively upbeat in March. Growth projections were boosted by the fastest improvement in suppliers’ delivery times for more than a decade. Survey respondents often cited improved availability of construction inputs and subsequent hopes that purchasing price inflation would moderate in the months ahead.’