Total construction output returns to growth in July

Commercial work gains momentum, helping to offset another sharp fall in house building

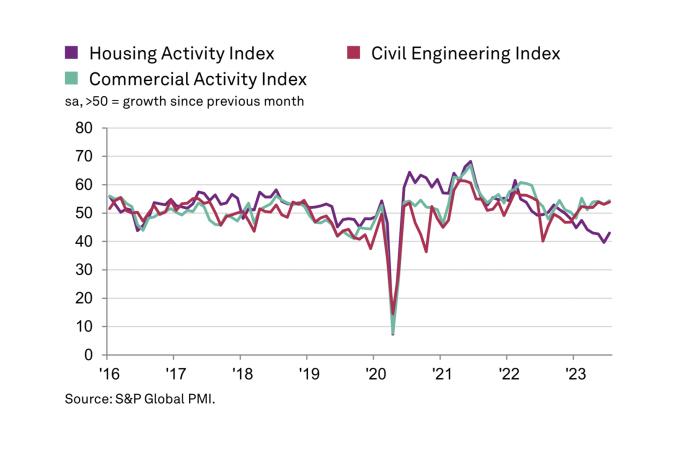

JULY PMI data signalled a renewed expansion of overall construction output, following the marginal decline seen during June. This was led by the strongest rise in commercial building since February and another solid contribution to growth from civil engineering activity. Meanwhile, latest data signalled another sharp reduction in residential construction activity.

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – posted 51.7 in July, up from 48.9 in June and the highest level for five months. However, the latest reading signalled only a moderate rise in overall construction output.

Robust increases in commercial building (index at 54.4) and civil engineering (53.9) were offset by a steep fall in house building (43.0). Lower volumes of residential work have now been recorded for eight consecutive months, although the rate of decline eased to its least marked since April.

Construction companies noted that rising borrowing costs had led to fewer sales enquiries and slower decision-making among clients in July. The latest survey pointed to only a marginal rise in total new work and the rate of growth was slower than seen on average in the first half of 2023. Some firms cited solid demand for refurbishment projects and greater opportunities for infrastructure work.

July data also indicated weaker demand for construction inputs. Purchasing activity has now decreased in each of the past two months, which reflected destocking efforts alongside subdued order books. A combination of lower demand and rising material availability contributed to a sharp improvement in supplier performance. Latest data illustrated that lead times shortened to the greatest extent for nearly fourteen-and-a-half years.

Business activity expectations for the year ahead remained positive overall in July and picked up slightly since the previous survey period. Reports from construction companies nonetheless indicated that pressure on customer budgets from higher interest rates remained a key factor holding back output growth projections for the next 12 months.

Tim Moore, economics director at S&P Global Market Intelligence, said: ‘July data indicated that some parts of the UK construction sector gained momentum, notably commercial building and civil engineering activity. This led to a renewed rise in total construction output which, although modest, was the fastest for five months. Survey respondents commented on increased infrastructure work, office refurbishments, and resilient demand for a range of commercial projects.

‘Meanwhile, another steep reduction in house building acted as a severe constraint on construction growth. Around 35% of the survey panel reported a decline in residential work during July, while only 18% signalled a rise. Lower volumes of housing activity have been recorded in each month since December 2022, with construction companies widely reporting subdued sales due to rising interest rates and worries about the economic outlook.’

Dr John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), added: ‘Decisions about buying a new home are being delayed by many consumers. Another fall in residential building levels and for the eighth month in a row, it’s obvious that UK interest rate rises, and cost of living pressures have dealt a hammer blow to the housing sector. The commercial and civil engineering sectors remained the only engines of growth last month.

‘However, for those that secured additional work, the best improvement in delivery times for raw materials since March 2009 will be music to their ears as supply chain disruptions improved and shortages lessened.’