MPA says ONS overestimating construction demand

Trade association figures indicate mineral products sales in Great Britain remained broadly flat in 2017

LATEST Office for National Statistics (ONS) data appear to overestimate construction demand for 2017, according to the Mineral Products Association (MPA). It says growth in mineral products sales in Great Britain (GB) ground to a halt last year across all major markets, except for mortar.

This is particularly significant for materials such as aggregates and ready-mixed concrete, which are the largest elements of the construction supply chain, ubiquitous to all types of construction work, and which are not usually stocked for future use on project sites.

It means that the MPA’s sales volumes survey, which represents 70–95% of the total GB market for these materials, can be used as a reliable and straightforward indicator of ongoing construction activity.

According to the MPA’s latest figures, sales volumes of ready-mixed concrete declined by 2.6% in 2017 compared with 2016, whilst asphalt (0.1%) and aggregates (–0.4%) sales remained broadly flat. Mortar sales, however, enjoyed another year of strong growth, up 11.1% compared with 2016.

The Association says that whilst the trend in mortar sales provides strong evidence of continued momentum in house building last year, sluggish markets for all other materials suggest construction activity in GB slowed down significantly in all other sectors through the year.

It says regional dynamics are also striking, with asphalt sales continuing to point to positive road activity in England being offset by sharp declines in Scotland. Similarly, the 2.6% fall in ready-mixed concrete sales was clearly driven by London and Scotland.

The London market for ready-mixed concrete has now seen five consecutive quarters of comparative decline, with sales volumes in the final quarter of the year 14% below levels seen mid-2016, albeit from a high point. Excluding London, ready-mixed concrete sales in the rest of GB show a more muted decline of 1.2% during the year.

However, in contrast to the MPA’s findings, the latest Office for National Statistics (ONS) data show a 5.1% increase in total construction output in 2017, an acceleration from the 3.9% growth rate seen in 2016.

Aurelie Delannoy, director of economic affairs at the MPA, said: ‘Given the weaker trends in mineral products sales last year, it seems hard to validate the ONS’s 5.1% growth in construction, let alone an acceleration in activity compared with 2016.

‘We believe construction was weaker last year than suggested by ONS. Nonetheless, our data suggests a return to growth in mineral products sales in the final quarter of the year, which is a welcome development, although it’s too early to say whether this is a sign of a more sustained and broad recovery in general construction work.

‘As a consequence of the financial crisis, the UK economy contracted by 4.6% during 2007-09, total construction output by 15.5%, new house building by 42% and mineral products markets by anything between 20% and 50%. Despite a few years of recovery and market growth since 2013, all the mineral products markets in GB remain well below pre-recession levels,' said Ms Delannoy.

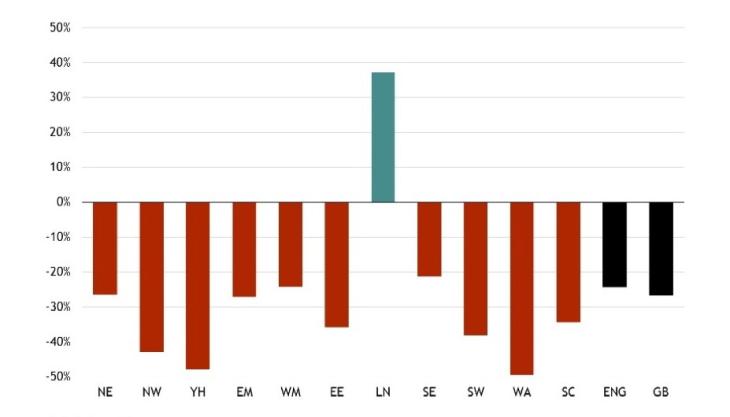

‘Regionally, however, some striking differences emerge, particularly ready-mixed concrete sales in London in 2017, which stood 37% higher compared with 2007, whilst volumes remained depressed in all other regions (see graph above). This has got to tell us something about the fragile and imbalanced state of our economy.’