House-building slump still weighing on UK construction output

November PMI data signals another sharp fall in housing activity as well as a marked reduction in total activity

UK construction companies indicated a decline in business activity for the third consecutive month during November, led by another sharp fall in residential building. Elevated borrowing costs and subdued demand for new housing projects were widely cited as factors holding back construction activity.

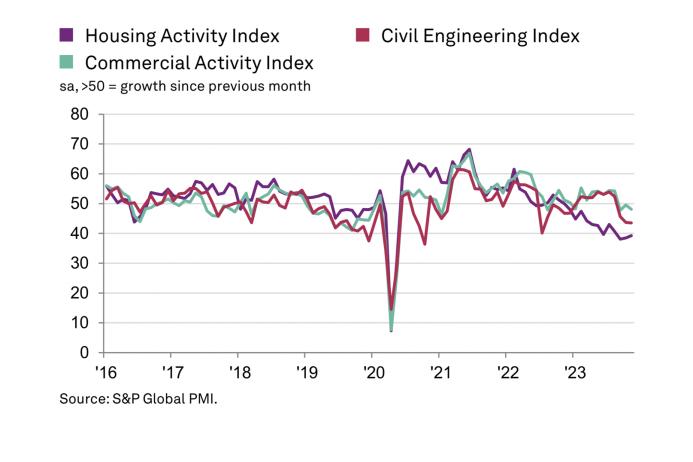

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) registered 45.5 in November, down fractionally from 45.6 in October and below the 50.0 no-change value for the third month running. The latest reading was the second lowest since May 2020 and signalled a marked reduction in total industry activity.

November data illustrated that house building (index at 39.2) remained by far the weakest-performing segment, followed by civil engineering (43.5). Survey respondents cited cutbacks to residential development projects and a general slowdown in activity due to unfavourable market conditions.

Commercial building showed some resilience (index at 48.1), but activity in this category has now decreased for three months in a row. Construction firms noted that lacklustre domestic economic conditions and delayed decision-making by clients on major investment spending had been factors limiting demand.

November data also suggested a continued lack of new work to replace completed projects. Total new orders decreased for the fourth month running, albeit at the slowest pace since August. Customer hesitancy and greater borrowing costs were often reported as weighing on sales volumes, especially in the housing category. Although business activity expectations for the year ahead picked up from October’s recent low, they remained notably weaker than seen in the first half of 2023.

Tim Moore, economics director at S&P Global Market Intelligence, said: ‘A slump in house building has cast a long shadow over the UK construction sector and there were signs of weakness spreading to civil engineering and commercial work during November.

‘Residential construction activity has now decreased in each of the past 12 months and the latest reduction was still among the fastest seen since the global financial crisis in 2009. Rising interest rates and the uncertain UK economic outlook also hit commercial construction, whilst a lack of new work contributed to the fastest decline in civil engineering activity since July 2022.’