Fastest upturn in UK construction output since April 2022

Steepest rise in civil engineering activity since June 2021; New orders grow at strongest pace for two-and-a-half years

SEPTEMBER PMI data indicated that business activity growth across the UK construction sector accelerated to its fastest for nearly two-and-a-half years. New work also expanded markedly, with rising demand attributed to increased willingness-to-spend among clients and a more supportive economic backdrop.

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – posted 57.2 in September, up from 53.6 in August and above the neutral 50.0 threshold for the seventh successive month. The latest reading signalled a strong upturn in total construction activity and the steepest rate of growth for 29 months.

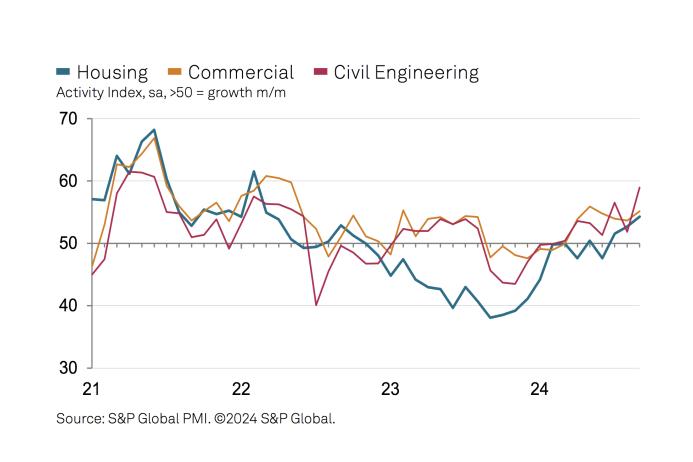

Faster rates of output growth were seen in all three sub-sectors monitored by the survey in September. Civil engineering (index at 59.0) was the best-performing category. Survey respondents commented on robust demand for renewable energy infrastructure and a general uplift in work on major projects.

Commercial building (55.2) also gained momentum in September, with output levels rising to the greatest extent since May. A number of firms noted that lower borrowing costs and domestic political stability had a positive impact on client spending, although survey respondents also noted tight budgets.

Improving market conditions and rising confidence helped to boost house building in September (54.3). The latest upturn in residential work was the fastest since March 2022, but still softer than seen elsewhere in the construction sector.

Total new orders expanded at the strongest rate for two-and-a-half years in September, whilst business activity expectations for the year ahead remained upbeat despite slipping to the lowest since April. Optimism was often centred on prospects for sustained growth in the house-building sector.

Tim Moore, economics director at S&P Global Market Intelligence, said: ‘UK construction companies indicated a decisive improvement in output growth momentum during September, driven by faster upturns across all three major categories of activity.

‘A combination of lower interest rates, domestic economic stability, and strong pipelines of infrastructure work have helped to boost order books in recent months.

‘Business optimism edged down to the lowest since April, but remained much higher than the low point seen last October. Survey respondents cited rising sales enquires since the general election, as well as lower borrowing costs and the potential for stronger house-building demand as factors supporting business activity expectations in September.’