Construction slowdown continues in June

Business optimism dips for fifth month running as housing activity falls for first time since May 2020

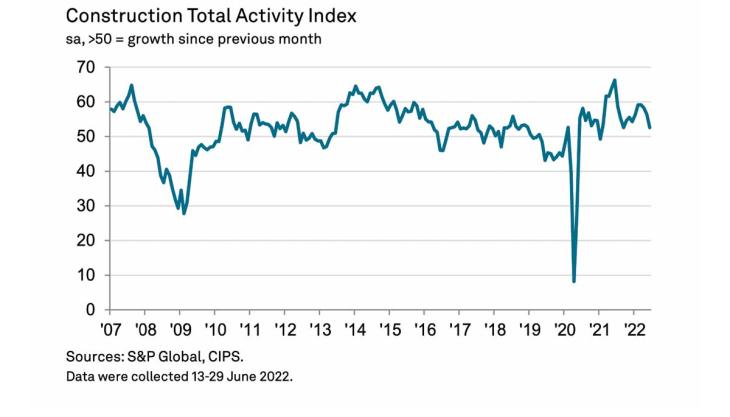

UK construction companies signalled another loss of momentum in June as total business activity expanded at the weakest pace for nine months and new orders increased to the smallest extent since last October. Worries about the near-term economic outlook led to a sharp decline in business expectations for the year ahead, with June data indicating that growth projections are now the least upbeat since July 2020.

At 52.6 in June, down from 56.4 in May, the headline seasonally adjusted S&P Global/CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – registered above the 50.0 no-change mark for the seventeenth consecutive month. However, the latest reading signalled only a moderate increase in construction output and the slowest rate of expansion since September 2021.

Civil engineering was the most resilient sub-sector in June (index at 54.3, down only slightly from 55.5 in May). A similarly strong increase in business activity was seen in the commercial segment, but the rate of growth eased sharply since May to the slowest so far in 2022 (index at 54.3, down from 59.8).

House building was the weakest-performing area of construction activity for the fourth month running in June. Moreover, the latest index reading of 49.3 signalled an overall downturn in residential work for the first time since May 2020.

June data pointed to a solid rise in total new orders, but the rate of expansion softened to its weakest since October 2021. Some construction companies noted a lack of new work to replace completed projects due to economic uncertainty and inflation concerns.

Meanwhile, input buying increased at a much slower pace than in May, with the latest expansion the weakest since the start of 2021. The loss of momentum was attributed to weaker new order growth and, in some cases, less safety stock building.

Suppliers’ delivery times lengthened again in June, but the downturn in performance remained less marked than that seen in the first quarter of 2022. Staff shortages and a lack of transport availability were the most cited reasons for longer wait times for construction products and materials.

Looking ahead, around 36% of construction companies anticipate a rise in business activity, compared to 17% that expect a decline. While this highlighted positive sentiment overall in June, the degree of optimism signalled was the lowest since July 2020. Weaker business confidence has now been recorded for five months running, largely reflecting subject growth expectations for the UK economy, alongside uncertainty about the impact of higher interest rates and escalating inflationary pressures.

Duncan Brock, group director at the Chartered Institute of Procurement & Supply (CIPS), said: ‘Returning from pandemic lockdowns has not been easy as builders now face greater affordability challenges, not just for staff wages, but also for the energy-intensive materials needed to deliver the pipelines of construction work they currently have. With a downbeat economic environment, the sector will be fearful about what is round the corner during the rest of this year.’