Is The Outlook For The Aggregates Market Still Encouraging?

First published in the January 2018 issue of Quarry Management as Reasons to be cheerful?

Just over a year ago BDS contributed the first in a series of bimonthly articles to Quarry Management. That article was entitled ‘Aggregates markets look encouraging for the next few years’ and gave a high-level status check of the industry’s prospects. Twelve months on, it is worth re-evaluating the position and to see whether we have more, or less, reasons to be cheerful.

In the previous article, we were envisaging modest growth influenced by factors including the prospect of major infrastructure projects; increased levels of housing development underpinning weaknesses in other key construction sectors; a Highways England road investment programme growing but geared towards the end of the decade; the economic uncertainty of Brexit; and regional disparity in the extent and rate of development across Great Britain.

Since then we have seen construction work start at Hinkley Point C and the first tranche of orders placed for HS2. Between them these schemes are valued at nearly £80 billion. The National Infrastructure and Construction Pipeline (NICP) has published its programme of projects to be delivered, which includes an average spend of around £60 billion in each of the next four years.

Elsewhere, an extra £6.1 billion programme of road improvements was unveiled in the summer and 10 Highways England (HE) schemes brought forward. The housing market was also provided with a significant boost in the Autumn Budget, as the Government increased its annual target of new homes from 200,000 to 300,000. To support this, it committed £44 billion of capital funding, loans and guarantees over the next five years. Around 20% of this will go towards helping private house building and private-rented construction, and the Housing Infrastructure Fund will be more than doubled in value.

The regional disparity in growth and development also received some government focus in the Budget. The Transforming Cities Fund, for transport infrastructure, was established, providing funding of

£1.7 billion to help develop projects including the Northern Powerhouse and Midlands Engine. Elsewhere, The West Midlands Combined Authority published a £3.4 billion blueprint for transport projects in the region.

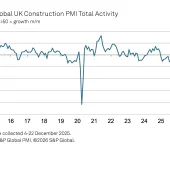

This level of activity is forecast to deliver further growth to the construction industry every year to the end of the decade. BDS believe the rate of growth will steadily improve in the next three years before rising towards 5% by 2020.

Whilst this all appears to be positive news for aggregates producers and downstream product manufacturers, there is always a flip side to every coin. From an economic perspective, despite the HE bringing some schemes forward in the summer, the overall backloading of projects in the programme was exacerbated as 22 schemes were delayed or cancelled. The total value of projects to be delivered through the NICP over the next 10 years was also recently downscaled, by nearly 10%, to £463 billion. Other projects have stalled, an example being the decision on the £1 billion Silvertown Tunnel in London, which has suffered a succession of delays. It will not be determined now until mid-2018 at the earliest.

A factor that could jeopardize the construction industry’s ability to deliver the Government’s plans is the prospect of a skills shortage. The Royal Institution of Chartered Surveyors has warned of the potential loss of 8% of the UK’s construction workforce post-Brexit. Some of this fear may have been allayed by the Government’s announcement in December that the 3 million EU citizens living in the UK will have the right to stay after March 2019, the date currently set for the withdrawal from the EU.

The wider implications of Brexit, and whether it will be ‘soft’ or ‘hard’, are still unknown. On a positive note, the recent announcement of the impending start of trade talks between the UK and the EU will be welcomed by all.

Whilst the identification, planning and financing of projects provides the end-markets for heavy building materials, the availability and security of aggregate reserves is the starting point in the ability to deliver them. There is the looming spectre of a disconnect between the Government’s plans, as laid out in the NICP, and its aspirations to deliver 300,000 new homes per year, and the ability of the aggregates industry to supply materials to satisfy those projects.

The aggregates industry has started to raise issues with the Government, industry bodies and planners with regards to the availability and replenishment of reserves of crushed rock and sand and gravel. In 2017, BDS published an analysis of the reserves and years life remaining of every consented site in Great Britain. The key conclusions drawn from the report were that consumption is exceeding replenishment, there is regional disparity in the availability of supplies to key markets, and current planning policy is not geared to supporting the economic aspirations of the country. The planning process is increasingly being seen as a potential handicap to the construction supply chain in terms of how long it takes for a company to identify, plan and bring to market new reserves. Furthermore, it is regarded by many as inconsistent in the way it is delivered by each planning authority and that landbanks and future supply are based on historical levels of consumption that are no longer relevant.

A further issue being experienced by aggregate companies is that landowners can see more attractive returns on the sale or use of their land in the short-to-medium term. This is generally for commercial or residential development, rather than having to consider aftercare plans for minerals that can stretch to 20 or more years after extraction has ceased.

The period to the end of the decade, and beyond, should still be seen as a significant opportunity for the aggregates industry with volumes set to grow, and companies should be looking to gear up their activities in response. This is despite a few challenges over which the industry can exert limited influence. In the areas that it can, such as reserves replenishment, the activity levels should be increased and the volume turned up.

For more information contact Andy Sales on tel: (01761) 433035; email: andy.sales@bdsmarketing.co.uk; or visit: www.bdsmarketing.co.uk

- Subscribe to Quarry Management, the monthly journal for the mineral products industry, to read articles before they appear on Agg-Net.com