UK construction sector returns to growth in March

Renewed increase in total industry activity and strongest increase in new orders since May 2023

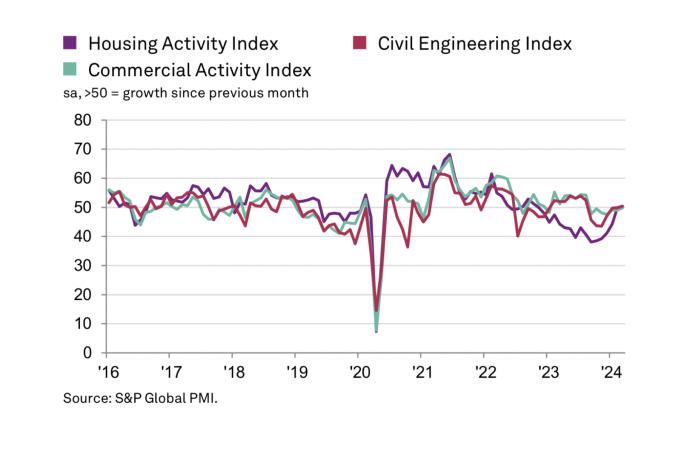

UK construction companies indicated a renewed increase in total industry activity during March, thereby ending a six-month period of decline. Survey respondents often commented on a turnaround in sales pipelines and greater new business enquiries linked to the improving economic outlook and more stable financial conditions. Adding to signs of a recovery in construction sector performance, new orders expanded at the fastest pace since May 2023.

The headline S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted index tracking changes in total industry activity – rose from 49.7 in February to 50.2 in March. Any reading above 50.0 indicates an overall expansion of construction output. Although signalling only a fractional rise in business activity, the index was at its highest level since August 2023.

Civil engineering was the best-performing segment in March, as output levels increased at a marginal pace. Panel members cited increased work on infrastructure projects and resilient demand in the energy sector.

House building and commercial construction activity were both broadly unchanged in March. The stabilization in residential work represented the best performance for this category since November 2022.

March data pointed to a moderate increase in new work received by construction companies. The rate of expansion has accelerated since February and was the strongest for 10 months. Anecdotal evidence pointed to a general rise in new project starts and greater tender opportunities across the construction sector so far in 2024.

Construction companies remain upbeat about their prospects for business activity in the next 12 months. Around 49% of the survey panel anticipate a rise in output levels, while only 11% predict a decline. That said, the degree of optimism eased since February and was the lowest in 2024 to date. Survey respondents typically commented on stronger order books and hopes that broader market conditions will continue to improve, especially in relation to house-building projects. Meanwhile, political uncertainty, squeezed margins and financial pressures were cited as factors weighing on optimism.

Tim Moore, economics director at S&P Global Market Intelligence, who compile the survey, said: ‘UK construction output returned to growth in March as a renewed expansion of civil engineering work was supported by more stable conditions in the housing and commercial building segments. The marginal overall rise in total construction activity ended a six-month period of contraction.

‘The near-term outlook for construction workloads appears increasingly favourable as order books improved again in March and to the greatest extent for just under one year. Construction companies generally commented on a broad- based rebound in tender opportunities, helped by easing borrowing costs and signs that UK economic conditions have started to recover in the first quarter of 2024.’