MPA reports decline in sales volumes in Q1

Weak construction and cold weather drive down demand for mineral products in first quarter of 2018

FOLLOWING some improvement in demand towards the end of 2017, mineral products markets started this year slowly, hit by weak construction activity and the impact of the particularly cold weather, according to the latest figures from the Mineral Products Association (MPA).

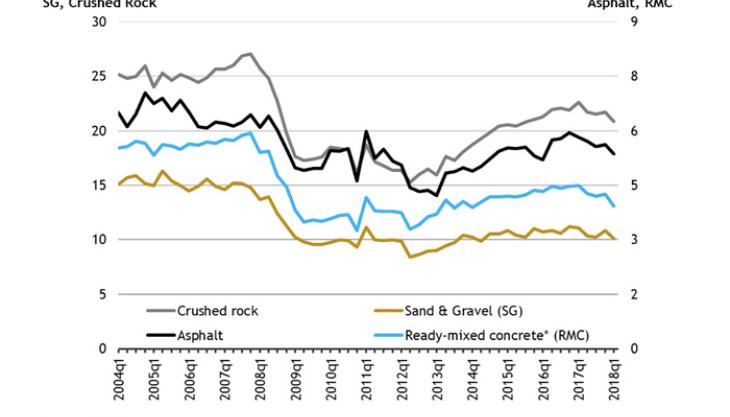

Sales volumes for asphalt and aggregates fell by 4.8% and 4.9%, respectively, in the first quarter of 2018, compared with the previous quarter, and ready-mixed concrete by 7.7%. Mortar sales, which last year received a significant boost from new house building, also contracted by 3.8% in the first quarter, the biggest quarterly fall since early 2013.

Weak sales volumes in the first quarter of the year can be partly explained by the impact of the unusually severe weather in the UK in late February and early March, with official statistics released last week showing that construction output declined by 3.3% over the quarter, the biggest quarterly fall since mid-2012.

However, longer-term trends in construction demand for mineral products confirm underlying weakening in construction activity, beyond the weather impact. Sales volumes for aggregates were 3.6% lower in the 12 months to March 2018, compared with the previous year, 4.5% lower for asphalt, and 6.7% lower for ready-mixed concrete, while over the same period, mortar sales volumes increased by 8.7%.

The continued weakening in the aggregates and ready-mixed concrete markets, not only at national level, but also across all regions in Great Britain, suggest that, outside new housing construction, there are limited sources of growth.

According to Aurelie Delannoy, director of economic affairs at the MPA, further growth this year in terms of new housing and infrastructure construction work should support mineral products markets, although this will be offset by an expected sharp decline in commercial work, the third biggest construction sector.

‘Should greater clarity emerge on the Brexit negotiations over the next few months, this would help unlock stalled investment decisions since the Referendum, although it would still take time for new investment decisions to translate into new market demand. This means mineral products producers are expecting a generally flat market this year,’ she explained.

‘Markets will have to wait for 2019, when a boost in demand should come from the planned acceleration in the Road Investment Strategy spending plans and work under way for HS2 and Hinkley Point C. It is, therefore, essential that there are no further delays on the delivery of these projects, and that any new and unnecessary sources of economic and political uncertainty are averted, to boost confidence and encourage positive investment decisions.’