Deepening challenges for construction revealed by MPA survey

Latest MPA survey suggests ongoing pressure on construction activity shows little sign of abating

THE latest quarterly data from the Mineral Products Association (MPA) paints a challenging picture for the construction industry, with a further deterioration in demand for heavy-side materials over the summer.

The new survey – an important bellwether of wider construction activity – reveals the extent of the slowdown in house-building activity, compounded by continuing delays in key infrastructure projects, particularly in roads, because of persisting cost pressures and planning challenges.

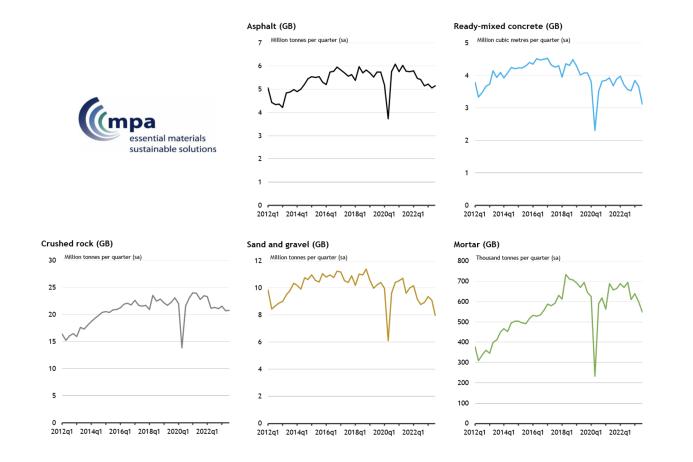

The third quarter saw notable declines in the sales of ready-mixed concrete and sand and gravel, with drops of 15.0% and 12.2%, respectively. For ready-mixed concrete, the magnitude of the decline is comparable to the first quarter of 2009, when macroeconomic and construction conditions were severely impacted by the global financial crisis. Mortar sales have also dipped, contracting by 8.7% in the third quarter if 2023, because of the sharp downward trend in house-building activity since the latter part of 2022.

Conversely, pockets of regional growth, notably in the east of England and the South East, have helped to avert a quarterly decline in the demand for asphalt and crushed rock. Asphalt sales inched up by 1.6% while crushed rock saw a marginal increase of 0.3%.

Despite fluctuations in materials volumes on a quarterly basis, the demand for all mineral products monitored by MPA has been on a declining trend for most of the past 18 months.

Growth in the demand for mineral products to deliver major infrastructure projects, including HS2 Phase 1, has been more than offset by a weakening overall pipeline of projects. Construction investment has been hit by the triple-whammy impact of cost inflation, rising interest rates, and weaker business and consumer confidence, all of which are weighing heavily on the financial viability of construction projects and on housing affordability.

Mineral products markets have also been impacted by repeated delivery setbacks in schemes to upgrade the strategic road network, managed by National Highways. Outside of Covid-impacted 2020, asphalt sales volumes are currently at their lowest level since 2014.

Other industry business surveys have indicated stagnation in the construction industry over much of the past year, but there has been a particularly marked slowdown since mid-July, as housing demand continues to adjust to higher interest rates and reduced affordability. Mortar sales, which are closely linked to house-building activity, are leading the decline in market sales, with an annual drop in volumes by 11.8% in the 12 months to September 2023.

Aurelie Delannoy, director of economic affairs at the MPA, said: ‘Faced with persistent headwinds, the construction industry, and its supply chain, including mineral products manufacturers, is in the midst of a challenging period. The decline in sales volumes for materials such as concrete and mortar reflects the broader issues faced by the sector, in particular the acute slowdown in house-building activity. MPA members do not foresee any improvement in market conditions in the near term, with weak construction demand likely to persist throughout most of 2024.

‘Ahead of the Government’s Autumn Statement, due this month, the industry is hopeful for policy measures aimed at supporting a revival in UK growth and business investment, as well as strengthening Government’s commitment to – and effective delivery of – the infrastructure project pipeline. However, the typical lag between policy announcements and projects starting means that tangible improvements in market conditions for producers of mineral products are unlikely to materialize next year.’

Mineral products such as aggregates, concrete, and asphalt represent the largest flow of materials in the economy and the single biggest segment of the construction industry supply chain. The MPA survey is, therefore, an important gauge of current and upcoming construction trends, shedding light on the essential heavy-side building materials markets. These materials are the backbone of construction, used throughout infrastructure and building projects, especially in the earlier stages. The latest results suggest the ongoing pressure on construction activity shows little sign of abating.