Construction output falls at steepest rate since April 2009

Latest IHS Markit/ CIPS UK Construction PMI data revels sharp loss of momentum in UK construction

JUNE data revealed a sharp loss of momentum for the UK construction sector, with business activity and incoming new work both falling at the fastest pace for just over 10 years. The slide in construction demand was mainly attributed by survey respondents to risk aversion among clients in response to heightened political and economic uncertainty.

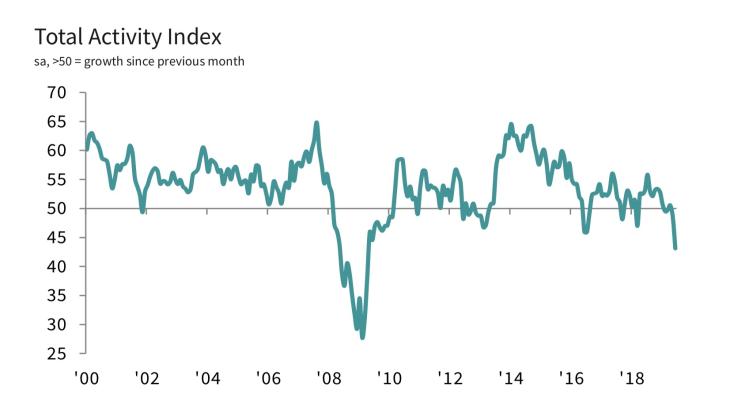

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index posted 43.1 in June, down sharply from 48.6 in May and below the 50.0 no-change mark for the fourth time in the past five months. Moreover, the latest reading signalled the steepest reduction in overall construction output since April 2009.

All three broad categories of construction activity recorded a decline in output during June. The fall in house building was the largest reported for three years, which construction companies linked to weaker demand conditions and concerns about the outlook for residential sales.

Meanwhile, commercial work fell for the sixth consecutive month and remained the worst-performing area of construction activity. The latest reduction in work on commercial building projects was the steepest since December 2009. Survey respondents often cited Brexit uncertainty and subsequent delays to project starts.

Civil engineering activity also declined at a sharp pace in June, with the rate of contraction the fastest since October 2009. Anecdotal evidence suggested that domestic political uncertainty, delays to new projects and longer wait times for infrastructure contract awards had all acted as a brake on business activity.

Tim Moore, associate director at IHS Markit, which compiles the survey, said: ‘The latest survey reveals weakness across the board for the UK construction sector, with house building, commercial work and civil engineering activity all falling sharply in June.

‘Delays to new projects in response to deepening political and economic uncertainty were the main reasons cited by construction companies for the fastest drop in total construction output since April 2009.

‘While the scale of the downturn is in no way comparable that seen during the global financial crisis, the abrupt loss of momentum in 2019 has been the worst experienced across the sector for a decade.

‘Greater risk aversion has now spread to the residential building sub-sector, as concerns about the near-term demand outlook contributed to a reduction in housing activity for the first time in 17 months.

‘Construction companies reported a continued brake on commercial work from clients opting to postpone spending, with decisions on new projects often pending greater clarity about the path to Brexit. Meanwhile, latest data indicated another sharp fall in civil engineering, which also reflected delayed projects and longer wait times for contract awards.

‘Worrying signals from the survey’s forward-looking indicators make it almost impossible to sugar-coat the Construction PMI data in June. In particular, new orders dropped to the largest extent for just over 10 years, while demand for construction products and materials fell at the sharpest pace since the start of 2010.

‘A continued lack of new work to replace completed projects illustrates the degree of urgency required from policymakers to help restore confidence and support the long-term health of the construction supply chain.’

Duncan Brock, group director at the Chartered Institute of Procurement & Supply (CIPS), added: ‘Purchasing activity and new orders dropped like a stone in June as the UK construction sector experienced its worst month for a decade.

‘This abrupt change in the sector’s ability to ride the highs and lows of political uncertainty shows the impact has finally taken its toll as new orders dried up and larger contracts were delayed again. The pain of Brexit indecision was felt across all three sub-sectors, but the previously resilient housing sector suffered the fastest drop in three years, which is, frankly, worrying news.

‘We are still a long way off the level of entrenchment seen in the last economic crisis, but with the onslaught of indecision combined with a weakening global economy, this could easily turn into more months of contraction as future optimism remains subdued.

‘A lack of clarity from policymakers has amplified the poor performance in June. Swift decision-making and a break in the political impasse hold the key to pulling the construction sector out of the quicksand.’