Construction output falls at its slowest pace since May 2019

Firms report boost from receding political uncertainty as business optimism rebounds to its highest since April 2018

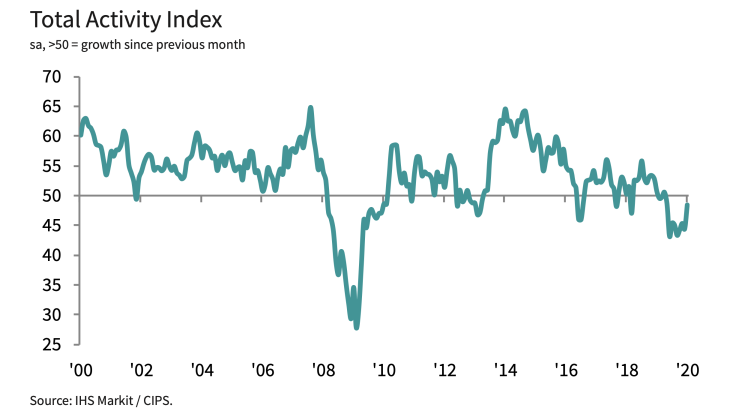

ACCORDING to the latest seasonally adjusted UK Construction Total Activity Index results from IHS Markit/CIPS, January data pointed to a much slower decline in UK construction output than that seen at the end of 2019 and new business volumes were also close to stabilization, which contrasted with the sharp falls seen in the final quarter of last year.

Survey respondents also widely commented on a boost to client demand from receding political uncertainty. Looking ahead, construction companies are now the most optimistic about their growth prospects since April 2018. A number of firms noted that clients’ willingness to spend had picked up after the general election, which should translate into rising workloads over the course of 2020.

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index rebounded from 44.4 in December to 48.4 in January. The latest reading was still below the 50.0 no-change threshold, but signalled the slowest fall in overall construction output for eight months.

House building was the best performing broad area of construction activity, with output falling only slightly in January. Mirroring the overall construction output trend, residential work fell at the slowest pace since May 2019.

Commercial activity decreased for the thirteenth consecutive month in January, but the rate of contraction was much weaker than in December and the softest since the start of 2019. A number of survey respondents noted that reduced domestic political uncertainty had the potential to unlock new projects and provide an additional boost to client spending.

Meanwhile, civil engineering was the worst performing category of output in January, with construction firms often citing a lack of tender opportunities to help replace completed infrastructure contracts.

January data indicated only a slight drop in new orders received by construction companies. The rate of new business contraction has eased sharply since December and was the least marked in the current 10-month period of decline. Anecdotal evidence suggested that greater clarity in relation to Brexit following the general election had a positive impact on demand, especially in the residential development category.

Tim Moore, economics associate director at IHS Markit, which compiles the survey, said: ‘The construction sector downturn lost intensity in January amid slower reductions in house building, commercial work and civil engineering activity.

‘Measured overall, the latest dip in construction output was much shallower than in December, with survey respondents often commenting on improved willingness to spend among clients since the general election.

‘Commercial work dropped at the slowest pace since the start of 2019 and was the main beneficiary of receding political uncertainty. UK construction companies also commented on signs of a turnaround in demand conditions across the residential development category during January. Civil engineering remained the weakest performing area of construction work as firms across the supply chain cited a lack of opportunities to replace completed contracts.

‘Despite concerns about prospects for work on infrastructure projects, latest data revealed a strong rebound in business optimism across the construction sector as a whole in January. The degree of positivity reached its highest level since April 2018, driven by hopes that improving confidence among clients will continue to translate into new contract awards over the course of 2020.’