Construction moving towards more subdued recovery

New order growth starting to slow as rising costs and economic uncertainty begin to hit demand

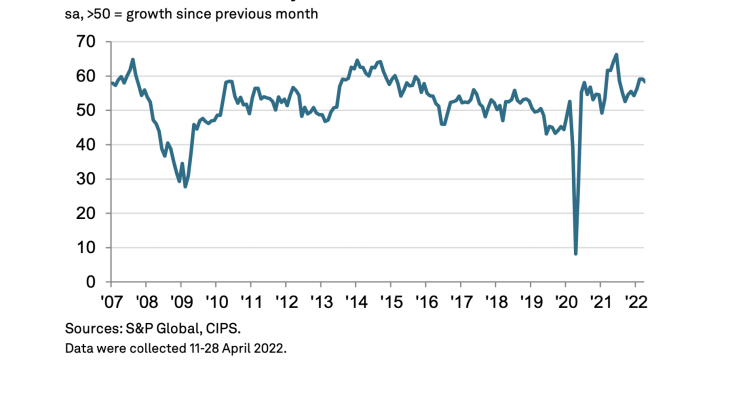

WHILST UK construction companies reported another strong rise in business activity during April, the speed of recovery lost momentum amid weaker new order gains, with higher costs and worries about the economic outlook starting to act as a brake on demand.

Signs of a slowdown in client spending contributed to another drop in growth expectations, with the degree of optimism about future workloads the lowest since September 2020.

At 58.2 in April, down from 59.1 in March, the headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – signalled the weakest rate of output growth since January.

The index has, nonetheless, posted above the crucial 50.0 no-change mark in each month since February 2021.

Of the three main construction segments monitored by the survey, the fastest growing remained commercial work (index at 60.5), followed by civil engineering (56.2).

Construction firms cited pent-up demand for commercial projects and spending related to COVID-19 recovery plans, whilst major infrastructure schemes such as HS2 were reported as factors helping to boost civil engineering activity. Residential work remained the worst-performing sub-sector in April and saw the greatest loss of momentum (53.8 vs 54.9 in March).

Looking ahead, however, the percentage of construction companies forecasting an upturn in business activity during the next 12 months (43%) continued to surpass those expecting a fall (12%).

Tim Moore, economics director at S&P Global, which compiles the survey, said: ‘The construction sector is moving towards a more subdued recovery phase as sharply rising energy and raw material costs hit client budgets.

‘House building saw the greatest loss of momentum in April, with the latest expansion in activity the weakest since September 2021. Commercial and civil engineering work were the most resilient segments, supported by COVID-19 recovery spending and major infrastructure projects respectively.

‘Construction companies have built up strong order books since the reopening of the UK economy…and these project starts should keep the sector in expansion mode during the remainder of the second quarter.

‘However, tender opportunities were less plentiful in April as rising inflation and higher borrowing costs started to bite. Consequently, longer-term growth projections have slumped from January’s peak, with business optimism now the weakest since September 2020.’