Market activity eases off but further growth likely

MPA says latest sales figures confirm flattening in construction, but prospects remain positive

ACCORDING to the latest quarterly figures from the Mineral Products Association (MPA), minerals products sales volumes remain robust, driven by higher road investment.

Sales volumes of asphalt were 5.7% higher in the third quarter of 2015 than in the same quarter of 2014, and sales of aggregates and ready-mixed concrete were up 2.2% and 1.1%, respectively, on the same period last year.

In the 12 months to September 2015, asphalt sales grew by 9.6% compared with the previous year, aggregates sales were 6.5% higher over the same period, and sales of ready-mixed concrete, which started to recover ahead of other markets following housing activity, grew by 3.8%.

Seasonally adjusted volumes for the third quarter, which strip out periodic swings in sales related to changing seasons, show a flattening in activity, although sales were slightly stronger than in the second quarter across most materials.

The MPA says some moderation in growth rates was to be expected, given the very strong volumes seen in the second half of 2014 and early 2015.

It adds that markets in London remain strong, with ready-mixed concrete volumes 2.5 times higher than in 2009 and sales in the year to September 2015 up 8.5% compared with the previous year.

Major construction projects also led to strong third-quarter sales of aggregates, asphalt and ready-mixed concrete in Scotland.

Whilst recent preliminary GDP figures from the ONS indicated that third-quarter construction output contracted by 2.2% compared with the second quarter, MPA data suggest a less gloomy picture with longer-term trends remaining positive.

The Association says expectations for construction output and mineral products demand remain positive for 2015 and the following years, assuming further growth in new housing and commercial and infrastructure work materializes as planned.

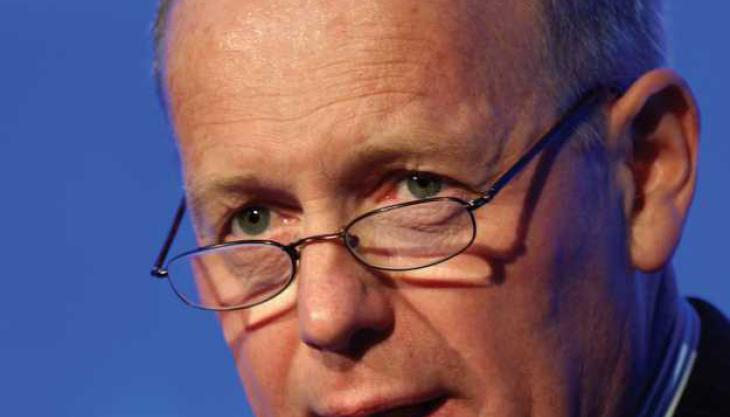

Nigel Jackson (pictured), chief executive of the MPA, commented: ‘Market growth has flattened out over the past six months following a strong 2014, but we anticipate some further improvement in 2016 given current economic and construction indicators.

‘In spite of some greater caution over economic prospects, further growth looks likely. There are signs that higher infrastructure spending is coming through in the roads sector and the Government has continued to take action to enable greater delivery of housing.’

He added: ‘We have called on the Government to act to ensure that mineral planning and regulatory processes are made more efficient and that energy-intensive domestic industries, such as cement and lime, receive the necessary protection from high UK energy and climate change costs, to ensure that key UK construction and industrial supply chains remain internationally competitive and secure.’