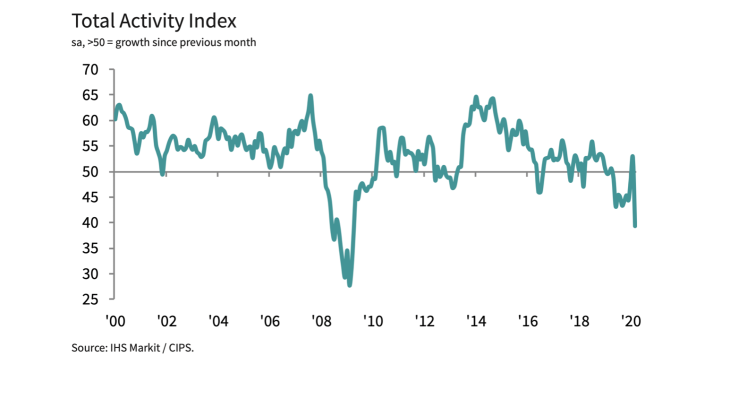

Construction work decline steepest since April 2009

Rapid falls in output and new work in March; business expectations weakest since October 2008

MARCH data pointed to the fastest downturn in UK construction output for almost 11 years as emergency public health measures to halt the spread of COVID-19 led to stoppages of work on site and a slump in new orders.

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index, published today, dropped to 39.3 in March from 52.6 in February, signalling the steepest fall in construction output since April 2009. Survey respondents overwhelmingly attributed reduced activity to the impact of the COVID-19 pandemic.

All three broad categories of construction work recorded a fall in output during March. Civil engineering activity (index at 34.4) saw the steepest rate of decline, followed closely by commercial building work (35.7).

Residential activity dropped at a comparatively modest pace in March, with the equivalent index posting 46.6. However, construction companies often commented on an expected slump in house building from stoppages on site amid increasing measures to slow the spread of COVID-19.

New work received by construction companies fell at a sharp rate in March, with the downturn in order books the fastest recorded by the survey since August 2019. Survey respondents commented on a combination of weaker demand and concerns among clients about the feasibility of starting new projects during the COVID-19 outbreak.

Construction companies also recorded intense supply chain pressures in March as the COVID-19 pandemic resulted in reduced capacity and shortages of stock among vendors. The latest lengthening of lead times among vendors was the steepest recorded since October 2014.

Input buying dropped at the fastest rate for six months. Average cost burdens continued to rise in March, although the rate of inflation moderated since the previous survey period amid softer demand conditions and lower commodity prices.

Meanwhile, latest data indicated a slump in business expectations across the UK construction sector. Survey respondents are more pessimistic about the year-ahead outlook than at any time since October 2008, which was almost exclusively attributed to the economic impact of the COVID-19 pandemic.

Tim Moore, economics director at IHS Markit, which compiles the survey, said: ‘March data provide an early snap-shot of the impact on UK construction output from emergency public health measures to halt the COVID-19 pandemic, with activity falling to the greatest extent since the global financial crisis.

‘The closure of construction sites and lockdown measures will clearly have an even more severe impact on business activity in the coming months. Survey respondents widely commented on doubts about the feasibility of continuing with existing projects as well as starting new work.

‘Construction supply chains instead are set to largely focus on the provision of essential activities such as infrastructure maintenance, safety-critical remedial work and support for public services in the weeks ahead.’

Duncan Brock, group director at the Chartered Institute of Procurement & Supply, added: ‘The battered construction sector was offered a brief respite in February with a marginal rise in output after a difficult year, but any hope of a continuation of growth was mercilessly bulldozed away in March and construction companies registered their lowest levels of optimism since October 2008.

‘With no upturn in sight, and with the fastest level of layoffs since September 2010, the sector is stuck in quicksand and sinking further. Though lower commodity prices will bring some relief for those that can source a limited number of materials amidst disrupted supply chains, this will be cold comfort without sites to work in and staff available as health concerns remain. The brutality of this impact cannot be underestimated, and the sector has not hit rock bottom yet.’