Construction sector growth slows in August

But business expectations hit six-month high on hopes of boost from infrastructure work

AUGUST data pointed to a setback for the recovery in UK construction output, with growth easing from the near five-year high seen during July. Survey respondents mostly suggested that a lack of new work to replace completed contracts had acted as a brake on the speed of expansion.

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered 54.6 in August, down from 58.1 in July (any figure above 50.0 indicates growth of total construction output).

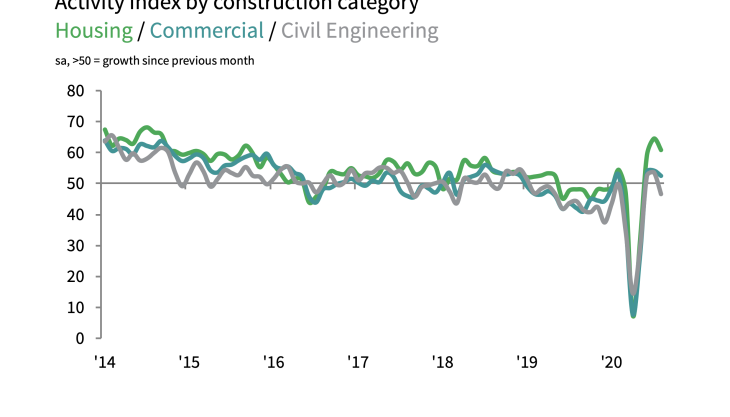

Higher levels of activity have been recorded in each of the past three months, but the latest expansion was the weakest over this period. All three broad categories of construction provided a weaker contribution to the headline index in comparison with those seen in July.

House building has registered the strongest rebound since the stoppages of work on site in late-March due to the coronavirus pandemic. This trend continued in August, with the seasonally adjusted Housing Activity Index posting well inside expansion territory (60.7).

The equivalent figures for commercial work (52.5) and civil engineering activity (46.6) were notably weaker than the headline index in August.

Total new business volumes increased for the third month running during August, but the rate of expansion remained only modest and slowed since July. Construction companies noted that economic uncertainty and a wait-and-see approach among clients had limited their opportunities to secure new work.

However, there were once again a wide range of comments from survey respondents in relation to the strength of their order books, which largely mirrored the multi-speed recovery experienced across different sectors of the UK economy.

And, despite reporting subdued new business intakes since the start of the pandemic, construction companies reported an improvement in their business expectations for the year ahead.

More than twice as many survey respondents (43%) expect a rise in construction output over the next 12 months as those that anticipate a fall (19%). This was often linked to hopes of a boost from major infrastructure projects and resilient public sector construction spending.

Tim Moore, economics director at IHS Markit, who compile the survey, said: ‘The latest PMI data signalled a setback for the UK construction sector as the speed of recovery lost momentum for the first time since the reopening phase began in May.

‘House building remained the best-performing area of construction activity, with strong growth helping to offset some of the weakness seen in commercial work and civil engineering activity.

‘The main reason for the slowdown in total construction output growth was a reduced degree of catch-up on delayed projects and subsequent shortages of new work to replace completed contracts in August.’

On a more positive note, Mr Moore added that business expectations climbed to a six-month high in August as construction firms turned their hopes towards a boost from major infrastructure work and reorienting their sales focus on new areas of growth in the coming 12 months.