Construction output forecast to grow by 2.1% in 2018

Leading Edge consultancy says growth to be driven by public housing, private housing and infrastructure

TOTAL GB construction output is forecast to see volume growth of 2.1% this year, a lower growth figure than in 2017, which saw a year on year increase of 5.1%, while total output (at 2015 prices) is forecast to increase to £159.6 billion in 2018.

These are among the latest findings of research and strategic marketing consultancy Leading Edge, who have been producing regular construction output forecasts for the last 25 years.

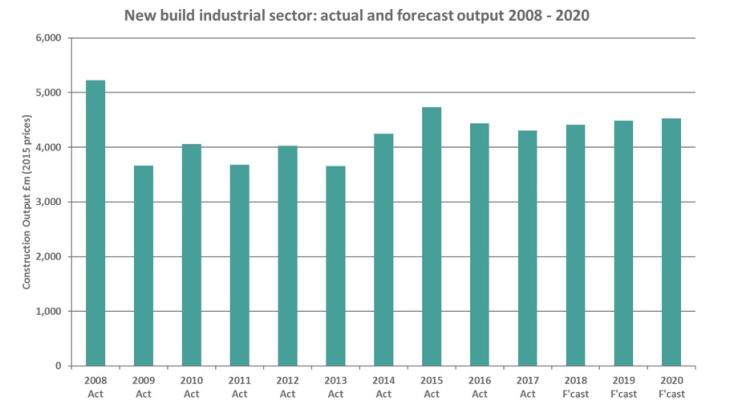

According to the consultancy, construction growth in 2018 will mainly be driven by public housing, private housing and infrastructure and, to a lesser extent, the industrial sector and repair and maintenance in private housing. However, the commercial sector, one of the largest parts of the market, will see a decline.

Although GDP growth is expected to be broadly maintained at around 1.7% per annum in 2018, according to Treasury forecasts, the uncertainties surrounding Brexit will slow growth in some sectors, in particular office construction.

However, to put these figures into context, the total output in 2018 is still forecast to be the highest level of construction output on record as the growth sectors are expected to more than outweigh those that are in decline or static.

Leading Edge director Mel Budd said: ‘Looking ahead to 2019 and 2020, we expect to see total construction output continue to see real growth, although performance will vary by sector and with the inevitable caveats on Brexit uncertainties.

‘The office market is likely to be the hardest hit. Overall activity will be boosted by large increases in output in the infrastructure sector where spending on energy, road and rail projects will grow. Public housing will also benefit from new government initiatives to boost the housing stock.’

Mr Budd added: ‘Although it may yet see some minor revisions, the total output figure for 2017 means that the construction industry has grown in real terms for five years in a row with the last three years seeing record-breaking levels of output. Total construction output in 2017 was 26.1% higher than 2012 in volume terms.’

Output would have been higher in 2017 following strong growth from the first to the third quarters, but it fell away in the final quarter (Q4), in particular in public, industrial and commercial new build. In these sectors Q4 output was lower than the equivalent quarter in 2016, which may be a sign of things to come, say Leading Edge.

The public sector consists mainly of education and health while commercial consists of offices, retail and leisure. New orders in 2017 (a forward indicator of output) also showed a marked decrease in commercial.

The main growth areas in 2017, compared with 2016, were public housing (+13.1%), private housing (+8.3%), repair and maintenance in private housing (+9.9%), infrastructure (+6.7%) and commercial (+4.9%), while two sectors declined year on year: public (–3.6%) and industrial (–3.0%).