Health check for the asphalt industry

First published in the March 2017 issue of Quarry Management

Much has been made in recent years about a lack of investment in Britain’s roads in terms of both adding new capacity and maintaining the existing network. The effects of this have been seen in the size of the asphalt market, which has been cut by nearly a half over the last two decades. At the same time, the number of asphalt producing companies and manufacturing plants in operation has also fallen significantly.

However, activity over the last few years has shown some level of recovery to provide some optimism for the industry, albeit from a low starting point. A dozen new plants or previously mothballed plants have opened in the last two years. In addition, in the last six months there has been a rise in the level of planning activity relating to new plants, potentially adding further capacity to the industry. Asphalt companies have started to see the promised investment being delivered and are responding to the need to replace some of the capacity that was lost. There has also been some acquisition activity in the last few months – a further indication of some strength returning to the market.

In previous articles published in this series, on aggregates and ready-mixed concrete, BDS have commented on the presence of the top five producing companies in each industry. However, neither of these sectors has as high a level of concentration as the asphalt market. More than 80% of asphalt production in Great Britain is accounted for by Tarmac, Aggregate Industries, Hanson, Breedon and CEMEX. This level has remained virtually unchanged since the beginning of the century, despite the changes in company and plant ownership and demand for asphalt during that period (following the recent acquisitions, consolidation in the market has increased further, with the share represented by the top six companies heading towards 90%).

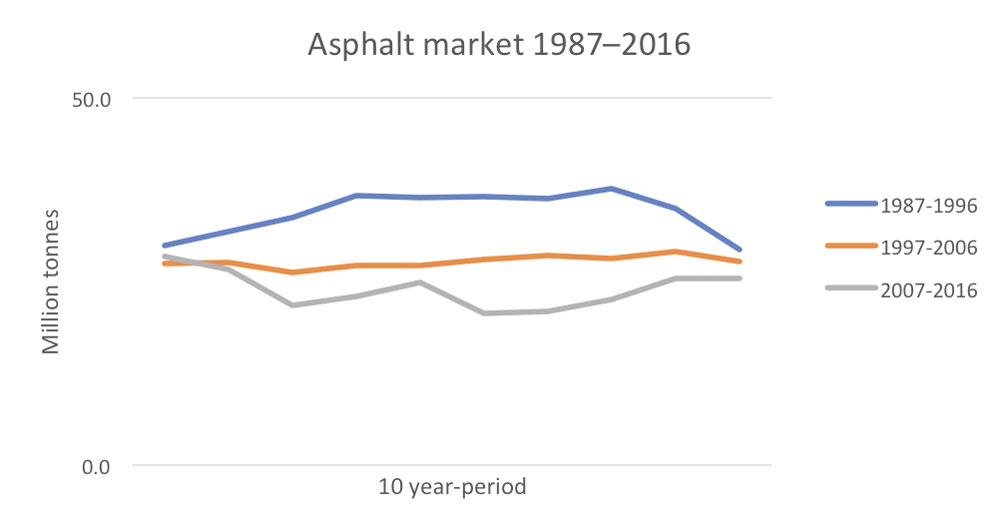

Looking back at the market over the last 30 years, it can be seen that asphalt production has contracted overall. Each of the last three decades has had different characteristics in terms of demand profile. The economic recessions that occurred in the early 1990s and late 2000s, with subsequent cuts in public spending and new road building and maintenance expenditure, saw the market fall from a peak of almost 40 million tonnes to a low of just over 20 million tonnes.

Asphalt companies have had to evolve to meet the tougher market conditions. A number of the recent planning proposals have been put forward by companies holding either Highways England or local authority term maintenance agreements, to construct new plants to service those contracts, giving them greater control over their supply and cost base.

In another development, one asphalt producer has constructed a bitumen import terminal to supply its own network of plants in the South East. The reduction in the level of bitumen production in Great Britain in the last 5–10 years has led to an increased reliance on imported bitumen and the construction of other import terminals around Britain. The cost of bitumen is a key element in the pricing model for asphalt, with the post-Brexit fall in sterling and the cut in production announced by OPEC in January both putting increased pressure on margins in the industry.

The prospects for asphalt demand are, however, starting to improve. Much of the reason for the renewed activity is due to the planned expenditure announced by Highways England (HE), which manages the strategic road network in England, the Office for Road and Rail (ORR) and details contained in the Government’s Autumn Statement.

Despite a small fall in 2017/18, HE annual capital spend will nearly double over the next four years to almost £3 billion per annum. Expenditure reported by ORR is also set to rise in each year to 2020, while in November last year the Government announced more than £1 billion of extra funding to support modifications to the local road network.

Despite this, there are still two flies in the ointment currently. The first is that some of the projects identified for investment have been slow to move forward. This has led to a build-up of projects towards the back of the period with the potential for further delay.

The second is the ongoing discussions over the terms of how Britain completes its exit from the European Union. The impacts of the fall in the value of sterling, a potential rise in inflation, reduced support for regions previously helped by the EU and possible adjustments to government spending as a result, are yet to be fully realized.

This is reflected in the BDS forecast for asphalt outputs over the next few years. The market plateaued in 2016, with virtually no change on the volumes seen in 2015. It is likely that the current year will see little change in output again, before the new workload kicks in and the market starts to rise. On this basis, the asphalt industry should feel optimistic that demand will improve, even if it takes an extra year or two to arrive.

This is the third in a series of bimonthly features by BDS Marketing Research into trends in the markets for aggregates, asphalt, concrete and cement. For further information on BDS-published reports on these markets and/or bespoke client research, please contact Andy Sales at: andy.sales@bdsmarketing.co.uk; or tel: (01761) 433035.

- Subscribe to Quarry Management, the monthly journal for the mineral products industry, to read articles before they appear on Agg-Net.com