UK construction sector gains momentum

Commercial work propels construction growth to a six-month high in January after subdued end to 2021

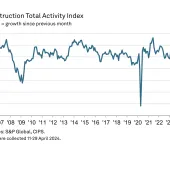

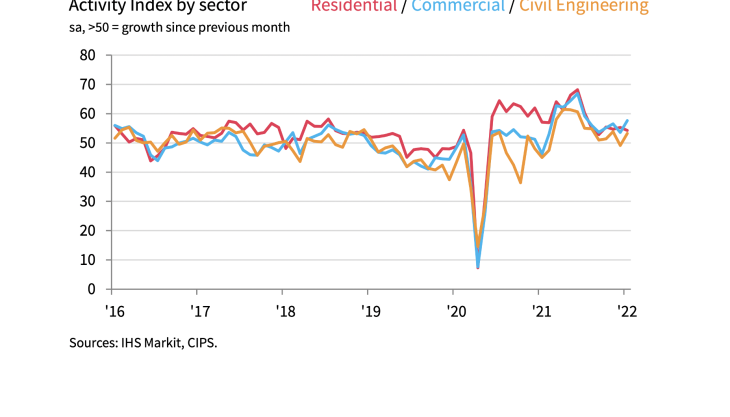

BUSINESS activity in the UK construction sector increased for the twelfth consecutive month in January with growth picking up since December, according to the latest PMI data compiled by IHS Markit and CIPS. There were also encouraging signs for the near-term outlook as new orders rose at the fastest pace since August 2021.

At 56.3 in January, up from 54.3 in December, the headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index registered above the crucial 50.0 no-change mark for the twelfth month in a row. Moreover, the latest reading signalled the strongest rate of output expansion since July 2021.

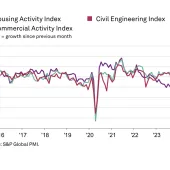

Commercial work was by far the best-performing category (57.6), with growth accelerating to a six-month high amid a boost to client demand from recovering UK economic conditions. Many survey respondents noted that optimism about the roll-back of pandemic restrictions had led to greater spending on commercial construction projects.

Civil engineering returned to growth in January (53.2), although the rebound was softer than seen in other parts of the construction sector. Meanwhile, house-building activity increased at the slowest pace for four months (54.3).

January data illustrated a robust and accelerated rise in new work received by construction companies. The rate of growth was the fastest since August 2021, which many survey respondents attributed to rising confidence among clients.

Despite another rise in demand for construction products and materials, the latest survey pointed to a turnaround in supply pressures, with construction firms recording the least widespread delays for almost one-and-a-half years.

The survey also indicated that construction companies continue to be highly upbeat about the business outlook. More than half of the survey panel (53%) forecast a rise in output during the year ahead, while only 5% predict a decline. Optimism was the strongest since May 2021 and largely reflected increasing tender opportunities and expectations of a swift recovery for the UK economy in 2022.

Tim Moore, director at IHS Markit, who compile the survey, said: ‘UK construction companies started the year on a strong footing as business activity picked up speed and new orders expanded to the greatest extent since last August. The composition of growth has become more tilted towards commercial projects as house building lost momentum and civil engineering remained subdued.

‘Commercial construction activity benefited from fewer concerns about the Omicron variant and strong business optimism about recovery prospects over the course of 2022, whilst residential work increased at one of the slowest rates since spring 2020, which is an early sign that cost-of-living concerns and rising interest rates could start to dampen the post-lockdown surge in spending.’