MPA welcomes positive Q1 results

Mineral Products Association sales volumes suggest continued impetus in construction in first quarter

CONSTRUCTION market demand for mineral products was higher in the first quarter of 2017 compared with the previous quarter, providing some evidence of continued impetus in construction activity at the start of the year, according to the Mineral Products Association (MPA).

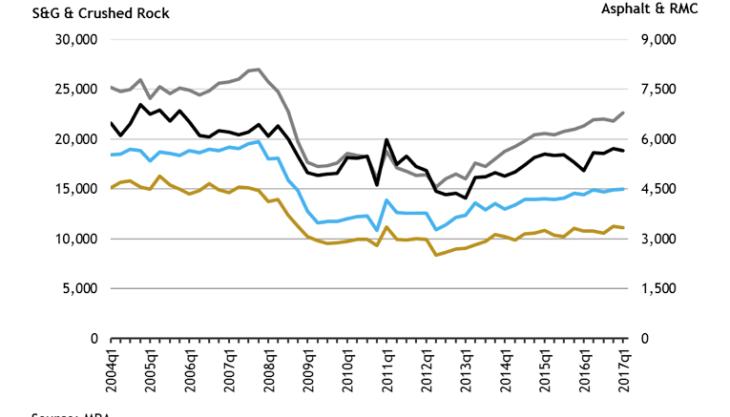

The Association’s latest seasonally adjusted survey of sales volumes show that sales of aggregates grew by 2.1% in the first quarter of 2017, compared to the previous quarter, and ready-mixed concrete by a positive, but more subdued, 0.7%.

Meanwhile, mortar sales accelerated further after the strong performance seen at the end of 2016, with volumes up 6.6% in the first quarter of this year. The rapid growth of the house building market since last summer suggests that housing remains the primary driver of construction activity.

The volume of asphalt sales, by contrast, declined by 0.8% in the first quarter of 2017.

Overall, sales volumes for the year ended 31 March 2017 revealed healthy rates of growth across all major MPA construction minerals, with asphalt up 5.2%, compared with the previous year, aggregates volumes up 5% and ready-mixed concrete up 4.3%. Mortar sales, the strongest market, grew by 6.9% over this period.

Ten months after the outcome of the EU referendum, the MPA says it is clear that markets and the construction sector have shown more resilience than expected.

There remains, nonetheless, one recurring issue for asphalt producers: whilst the overall annual performance in asphalt sales is positive, the quarterly profile points to a very uneven level of activity.

The industry has been raising concerns since the end of 2015 over the phasing and visibility of Highways England’s road programme, concerns that were supported by the recent findings of the National Audit Office. In its latest assessment on progress with the Road Investment Strategy, it found that Highways England was struggling to deliver planned projects.

According to the MPA, this situation makes it very challenging for the industry to gain a clear understanding of the asphalt market going forward and the timing of further increases in demand arising from Highways England’s road programme.

Aurelie Delannoy, chief economist with the MPA, commented: ‘We welcome the positive results in our markets in the first quarter of the year as a clear indication that construction activity still has some impetus.

‘Whilst mineral products producers remain relatively optimistic, their prospects for growth in the coming months may be dampened by the anticipated slowdown in both the general economy and in private construction activity this year.’

‘Post-election, the Government’s policy development and implementation, as well as swift and constructive progress in the Brexit negotiations, will be central to the future health of the UK economy, the construction sector and, ultimately, the mineral products sector.’